Pro Analysis

SCOTUS’ Tariff Case

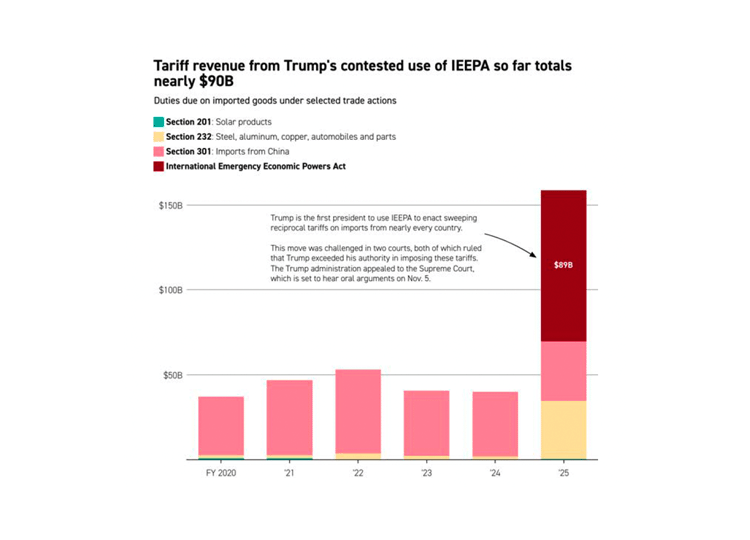

The Supreme Court will hear oral arguments Nov. 5 in a case testing the boundaries of presidential power over trade. The challenge targets President Donald Trump’s use of the International Emergency Economic Powers Act to impose tariffs — a move that could reshape how future administrations wield emergency authority.

This exclusive POLITICO Pro Analysis examines the competing legal arguments, the constitutional questions at stake, and the scenarios policy professionals are watching most closely as the Court prepares to rule.

Why it matters

- Learn what’s at stake for presidential authority and trade law

- Understand how the case could alter future tariff policy

- Explore the broader implications for U.S. economic governance

Access the full analysis

Designed for policy professionals, this POLITICO Pro Analysis delivers timely, expert insight into one of the most consequential trade cases in years. Download now to access the full breakdown of arguments, possible outcomes, and what’s next for U.S. policy.

Fill out the form to access this exclusive content. POLITICO Pro helps professionals stay ahead of policy shifts with real-time alerts, premium analysis, strategic tools, and access to an influential network.